You may have hesitated before tapping a credit app, wondering if that quick peek will cost you points you can not afford to lose. The short answer is simple. Checking your information through Credit Karma does not affect your score. Your score only moves when the underlying data in your credit files changes or when a lender performs a hard inquiry during an application. Understanding the difference between those two actions turns a vague fear into a practical plan.

Think of your credit score as a snapshot built from the data inside your TransUnion and Equifax files. Payment history, credit utilization, length of credit history, new inquiries, and account mix feed that snapshot. A viewing of the snapshot does not alter it. Credit Karma requests your information with what the bureaus call a soft inquiry. A soft inquiry is the same category as when you check your own credit directly, when a card issuer prequalifies you for an offer, or when an existing lender reviews your account behind the scenes. Soft inquiries do not influence your score. They are visible to you, but they do not show up to lenders as a signal of new borrowing risk.

Hard inquiries sit in a different bucket. A hard inquiry appears when you actively apply for a loan or a credit card, because the lender must assess your risk right before making a decision. Hard inquiries can trim a few points for a short period. They matter more if you stack several applications in a tight window and you have a thin file. The confusion arises because people often check Credit Karma right after applying, then watch their score dip, and blame the app. The timing becomes the culprit. The hard inquiry moved the score, not the soft check that Credit Karma used to display it.

There is another reason the myth persists. You may see one number in the app, then see a different number in a lender’s office. That mismatch can make it feel as if the app distorted something. In reality, multiple scoring models exist. Credit Karma typically shows a VantageScore that is built from your TransUnion and Equifax data. Many mortgage and auto lenders still rely on specific versions of FICO, sometimes older ones. Each model weighs the same ingredients, but the recipes differ. Utilization bands, thin-file treatment, and the way paid collections are handled can shift the result by a few points. Directionally, the models move together. If your utilization rises, both tend to fall. If you pay down balances, both tend to rise. The educational score in the app is useful for trend watching, even if the exact number a lender cites on decision day looks different.

Accuracy and utility are not the same thing, and you need both. Use the app for utility. It gives you regular visibility into the data that truly drives your score. Late payments appear if a servicer reports them. A new account shows up once the bureau receives it. A jump in reported balance will push utilization higher, which can lower the number temporarily. None of that movement is caused by Credit Karma. The app is a window. The glass does not create the weather.

If you prefer a simple mental model, frame your credit work in three parts. First, monitoring. Give yourself a cadence that lowers anxiety and catches problems early. Weekly is realistic for most people. Look for new accounts you did not open, balance spikes that reflect a statement cut you can manage differently next month, or a late mark that needs a direct conversation with the lender. Second, maintenance. This is where the habits live. Autopay at least the minimum on every account to protect payment history. Pay attention to utilization in the week before a statement date, not just the due date after it. Small mid-cycle payments can bring reported balances down before the snapshot is taken, which can help the number look like your actual behavior rather than a one-day spike. Avoid closing your oldest credit card without a clear reason, because length of history is a quiet but meaningful driver. Third, movement. This is about timing major applications. Group rate shopping for an auto loan within a tight window so the scoring model treats those hard pulls as a single shopping event. Give yourself a clean ninety days before a mortgage application to let recent balances settle and any disputes resolve. The plan is gentle. The results compound.

Let us address a few edge questions that come up in planning conversations. Does checking frequently look desperate to lenders? It does not. Lenders do not see your soft inquiries from Credit Karma the way you do. Will the app notify you if something important changes? It can, and those alerts are one of the best reasons to keep it installed. Identity theft trends have risen in recent years, and early detection makes all the difference. If you see a new account you did not open, freeze your credit files with the bureaus and escalate a fraud claim with the lender immediately. A freeze stops new accounts while you work through the paperwork. That sequence prevents score damage before it starts.

What about score swings that appear without any new activity? Two quiet forces can move the number even when you have not touched a card. The first is utilization. If a statement closes with a higher balance than usual because of travel or a one-time purchase, the model may read you as riskier until that balance is reported lower next cycle. The second is data updates across models. A paid collection that a lender updates today may not hit both bureaus on the same day. Expect minor short-term differences, then a reconvergence. The healthy response is not to chase the number, but to improve the inputs you control.

For major life decisions, replace fear with lead time. If you are preparing for a mortgage, the minimum goal is clarity on cash flow and total debt obligations six months ahead of an application. That timeline gives you room to lower utilization across all cards to the low-teens or better, correct any reporting errors, and avoid new hard pulls that would add friction. If you are planning for an auto loan, rate shop within a compact window, bring a recent pay stub, and arrive knowing your own number first. Walking into a dealership confident about your profile changes the conversation. When you are leasing an apartment, realize that a landlord may run a tenant screen that also uses a soft check or a specialized report. You can ask which service they use. Knowing this in advance allows you to set expectations and prepare documentation that shows stability.

There is also a sensible privacy conversation to have. Credit Karma is free because it earns revenue when users take certain actions in the app, for example applying for a partner product or clicking through to a lender. That does not harm your score, but it does mean recommendations are personalized based on your file. Treat those offers as options, not nudges. You can limit notifications, review the privacy policy, and enable two-factor authentication to protect your account. If you want the additional security of a credit freeze when you are not planning to open anything new, place it with each bureau. You can lift it temporarily when you apply. Safety and convenience can coexist if you plan.

If you live outside the United States, the vocabulary changes a bit while the principle stays the same. In the United Kingdom, for example, a soft search appears when you check your credit or when a bank does an eligibility check. Soft searches do not affect your score. In Canada, the idea mirrors the United States. Checking your credit through an app or directly with the bureau is a soft inquiry. Opening new credit is not a soft action, and lenders will run a hard inquiry as part of that process. The same planning lens works. Build a simple cadence for monitoring, protect payment history, and time new applications with intention.

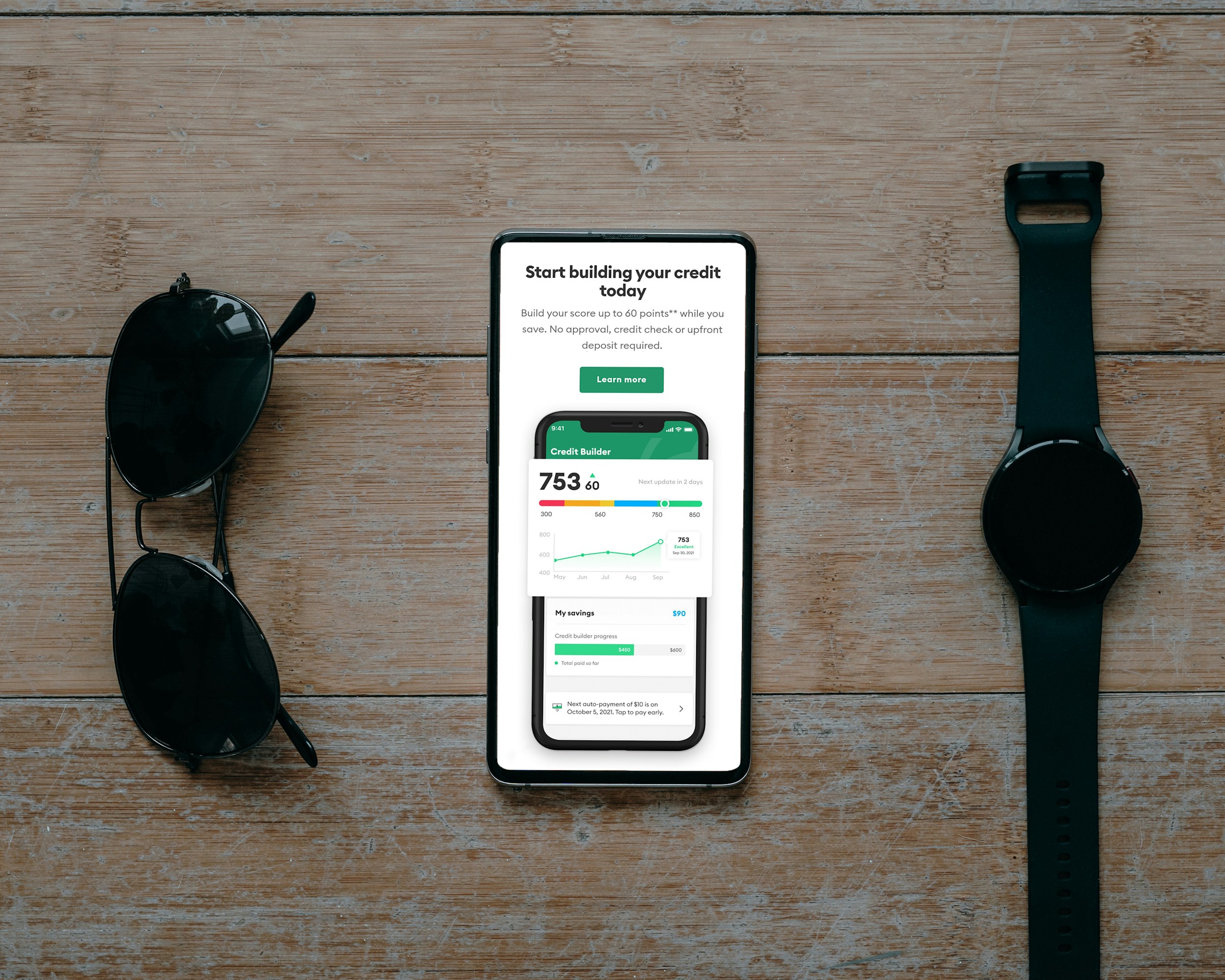

Use the number you see as a dashboard for behavior, not as a judgment. If the number dips after a holiday, pay the balances down and let the next statement reflect the change. If you see a late payment that surprises you, reach out to the lender. Many issuers will remove a single late mark for long-standing customers with clean histories. If your file is thin because you are early in your credit journey or newly arrived in a country, consider a secured card or a credit builder loan, then keep utilization low and payments on time. The first six months build the habit. The next twelve months build the truth that lenders will see.

A final reassurance is worth stating plainly. Credit Karma doesn't hurt your credit score. It shows you the state of your files using a soft inquiry that does not influence the models lenders use. The app is a tool. The score moves because of borrowing and repayment choices, not because you checked in. When you understand that separation, you can turn monitoring into a quiet advantage. You can plan big applications with less stress. You can treat the number as feedback rather than fate.

Healthy credit is not the product of a single hack. It is a set of small, repeatable behaviors aligned to your goals. Choose a monitoring rhythm you can keep. Automate what you can. Time your applications as if your future self will need the flexibility. The smartest plans are not loud. They are consistent. Start with your timeline. Then match the vehicle, not the other way around.