When a medical bill lands and you know you cannot pay it in full, your brain usually goes straight into alarm mode. You might think about ignoring it. You might be tempted to slap it on a credit card and hope Future You figures it out. Both of those reactions are understandable, but both of them can make things worse and more expensive.

The better move is to slow the situation down. The bill feels urgent, but in most systems the timeline is not measured in hours. It is usually weeks or even months before things escalate to collections. That gap is where you have leverage. Your goal is simple. Turn a scary unknown number into something you understand, something you can negotiate, and something you can actually pay on a timeline that fits your real life.

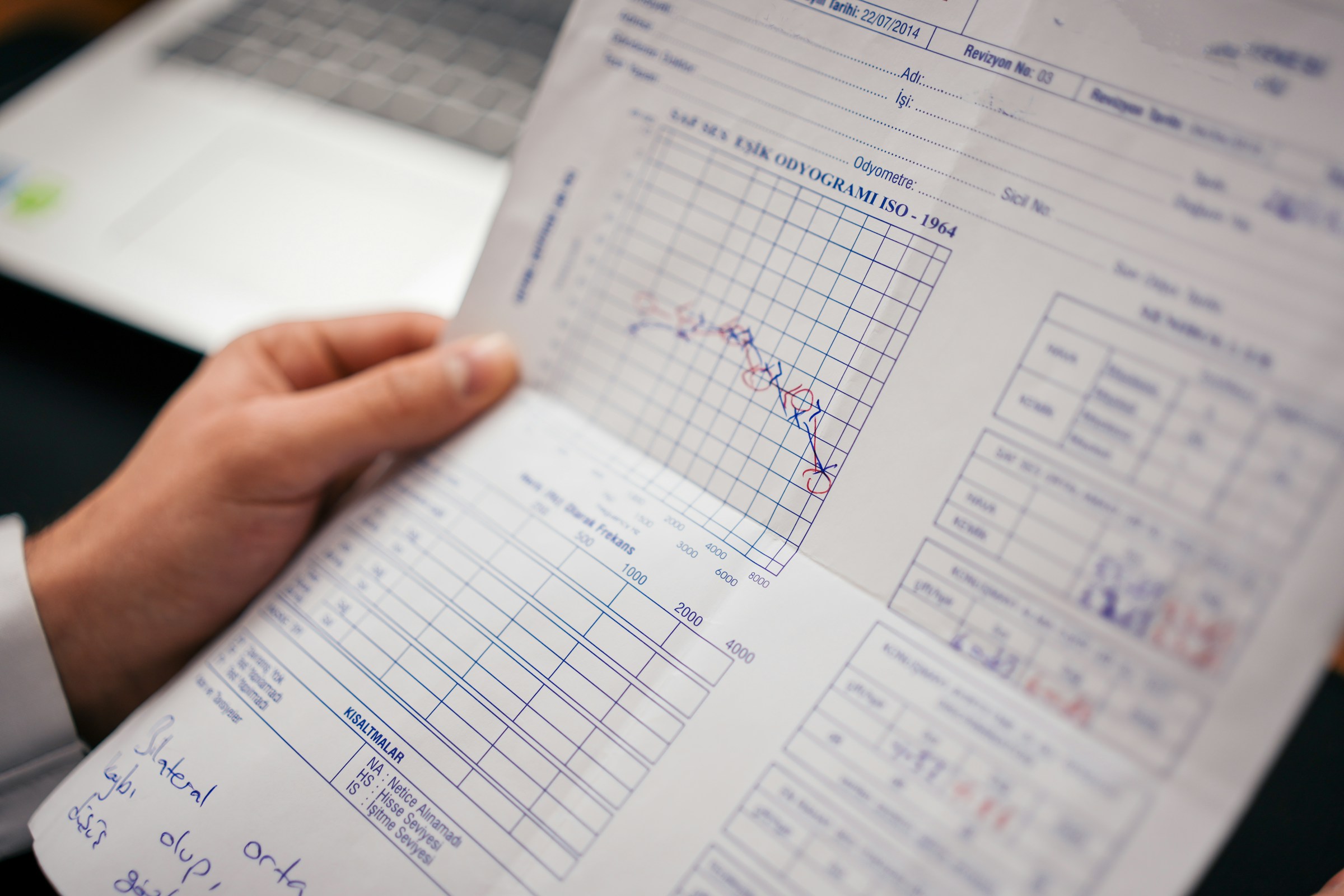

Start with the least fun but most powerful step. Check the bill line by line. Medical billing is notorious for errors. Sometimes you find procedures that were never done, duplicate charges, or items that should have been included in a package price instead of separate. Compare the bill to any explanation of benefits from your insurer or national health plan, and check that the dates, codes, and providers match. If you see something that looks off, call the billing department and ask them to explain that line item to you in plain language. You are not being annoying. You are literally checking what you are being asked to pay for.

Once you are sure the bill is accurate, the next step is to tell the provider the truth before the bill goes bad. Call the number on the statement, tell them you received a bill for X amount, and you cannot afford to pay it in full. This is not a debate about whether you should pay at all. This is about how to structure it. Ask what options exist for people who cannot pay the full balance. Most hospitals and larger clinics have internal rules for payment plans, discounts for upfront partial payment, or financial assistance programs, but they do not always advertise them in big friendly letters.

When you call, write down the date, the name of the person you spoke to, and what they offered. Staying organized gives you more power if you need to follow up later. Try to get any agreed plan in writing, even if it is an emailed confirmation. If you are dealing with more than one provider, for example a hospital plus a separate bill from the lab, repeat the process with each. It is tedious, but every negotiated bill is a smaller fire to put out.

One of the most underrated tools in this situation is the phrase: what is the lowest you can accept if I set up a plan or make a partial payment today. Many billing teams have standard discounts for people who are uninsured, underinsured, or paying out of pocket. You will not know that number unless you ask. Sometimes that discount can knock hundreds or thousands off the headline amount. That does not make the bill easy, but it makes it less impossible.

If your income is low, unstable, or you have dependents, ask specifically about financial assistance or charity care programs. Hospitals in many regions have obligations to offer reduced or even zero cost care if your income falls below certain thresholds. The application might require proof of income, bank statements, or tax returns, which is annoying, but the tradeoff can be huge. A bill that looks unpayable on paper can shrink to something manageable, or in some cases disappear entirely. This is not gaming the system. This is literally what those assistance funds are created for.

Next, zoom out and look at your monthly cash flow. The provider might suggest a payment plan number that sounds reasonable to them, but you are the one who knows your rent, food, transport, and existing debt payments. Before you agree to anything, run your own quick budget. Ask yourself what you can pay each month without skipping essentials. It is better to commit to a smaller amount you can actually maintain than agree to something bigger and default after three months. When you talk to the billing office, propose a number that fits your reality. If your situation changes later, call back and adjust rather than simply stopping payments.

What you want to avoid, as much as possible, is moving the problem from medical debt into toxic high interest debt. Putting a large hospital bill on a credit card or taking a high cost personal loan might feel like you are being responsible, because you are technically paying the bill. In practice, you could be turning a difficult situation into something that follows you for years through compounding interest. Medical providers might charge interest on long term plans, but it is often much lower than the rates on unsecured credit. Before you swipe, ask the provider directly whether there are interest free or low interest payment options, and compare that to any other credit you are considering.

If a collections agency enters the picture, your instincts might tell you it is game over. It is not. You still have rights, and you still have negotiation power. The tone of the letters or calls might be aggressive, but remember that agencies often buy debt for less than the original amount. That means there is sometimes room to negotiate a lower lump sum or a reasonable payment plan. When you talk to them, stay calm, keep the conversation factual, and always ask for any agreement in writing before you send money. Know that in some places medical collections are treated differently from regular debt for credit reporting, and recent rule changes have reduced how long certain medical collections can impact your score. The details vary by country, so it is worth checking reputable local sources or talking to a nonprofit credit counselor rather than trusting random internet threads.

Throughout this process, communication is your main defensive shield. Ignoring bills or calls tends to push the account along the most rigid pipeline, from reminder to final notice to collections. Calling early, explaining your situation, and proposing a plan can keep the account in a softer lane where negotiation is possible. Document everything. Keep copies of letters, emails, and screenshots of online account pages that show your payment history. If something gets misreported or sent to collections by mistake, that paper trail becomes your proof.

It can also help to get a neutral third party involved, especially if you are drowning in multiple bills or do not even know where to start. Look for nonprofit credit counseling services or patient advocate organizations in your country that specialize in medical bills. A good counselor can help you organize your accounts, understand your rights, and sometimes even negotiate on your behalf. Be careful with for profit “debt relief” companies that promise to erase your medical debt for a fee. Some are legitimate, many are not, and the last thing you need in this situation is another monthly charge draining your account.

If the medical bill is connected to an insurance claim, double check that the insurer has processed everything correctly. Sometimes a bill shows the full price before insurance actually pays its portion, or a claim has been denied for missing paperwork that can still be fixed. Call the insurer, quote the claim number, and ask what they have received and why anything was denied. If it was a coding issue or missing referral, your doctor’s office might be able to resubmit. This is slow and bureaucratic, but every dollar the insurer covers is a dollar you do not have to find in your own budget.

At the same time, use this whole mess as a signal to adjust your future protection if you can. That might mean signing up for a government health scheme you previously ignored, adding a basic insurance plan during the next enrollment window, or building a small dedicated health savings cushion as part of your emergency fund. You cannot rewind and undo the bill you already have, but you can reduce the odds that the next medical event puts you back in the same position. Even a consistent small amount tagged specifically for health costs can soften the next shock.

It is also valid to acknowledge the emotional side of this. Medical stuff is already scary because it is about your body, your health, or someone you care about. Throwing money stress on top can make it feel like your entire life is collapsing. That feeling can tempt you to avoid looking at the bill, or to say yes to the first payment plan someone suggests just to make the anxiety stop. Give yourself a day if you need to breathe, but then come back with a clear head and a notebook. Future You deserves a version of you right now who is willing to sit through some boring phone calls so that the damage is contained.

If you live in a place where medical debt can lead to legal action or wage garnishment, it is even more important not to guess. The rules around this are very specific to your country or state. If a bill is huge and you are getting letters that mention lawsuits or garnishment, look for legal aid clinics or consumer law centers that offer free or low cost advice. A brief conversation with someone who knows your local law can clarify what is actually possible and what is just intimidation language in a form letter.

The big mindset shift is this. A medical bill you cannot afford is not proof that you are bad with money. It is a sign that health care is expensive and often poorly designed for the way real people live and earn. Your job is not to fix the system. Your job is to navigate it as safely as you can. That means checking the math, asking for options, protecting your credit where possible, and avoiding moves that turn a painful event into a decade long financial drag.

So if you are holding that bill right now, do three things. First, read it slowly and make sure it is accurate. Second, call the billing office, tell them you cannot pay in full, and ask what genuine options exist. Third, choose a payment or support path that fits your real budget, not an imaginary one where you skip food or rent. This is not about being perfect. It is about keeping your financial life flexible enough that you can recover, heal, and keep moving.

.jpg&w=3840&q=75)