Many small businesses do not fail because the founder is careless or the product is weak. They fail because no one truly understands the money until it is too late. A shop can be full of customers, social media can look active, and the team can be working hard, yet the bank account quietly tells a different story. Rent, invoices, salaries, marketing spend, tax bills, and software subscriptions arrive in waves. On a slide deck the business looks promising. In the real world there may only be a few weeks of cash left.

If you are a small business owner, this situation may feel uncomfortably familiar. You spend your days handling customers, suppliers, and staff, and your nights staring at a spreadsheet that never feels accurate. You might tell yourself that proper financial planning will start once revenue is higher or once you are more established. The reality is the opposite. Without financial planning in the early stages, growth can be the thing that finally exposes how fragile your foundations are.

Financial planning is not about becoming a finance expert. It is about deciding in advance how your limited cash, time, and energy will be used, instead of letting emergencies and random events make those decisions for you. When you see it this way, planning becomes less of a paperwork task and more of a way to protect yourself, your team, and your business from chaos.

Small businesses often live in constant reaction mode. A client pays late, so you delay paying a supplier. A landlord asks for a higher deposit, so you reduce your marketing spend. A spike in raw material prices forces you to cancel something else on your budget. Life becomes a chain of short term fixes, and the business never really feels like it is under control. A financial plan does not remove surprises, but it makes them less dangerous. It forces you to answer basic but crucial questions. How much does it really cost to keep the business alive for one month. How much of your revenue is predictable and how much is just hope. Which expenses are truly essential because they keep the engine running, and which are flexible.

Once those numbers are clear, your decisions become sharper. You stop saying yes to every opportunity that appears and start checking whether it fits the rhythm of your cash flow. You know when large bills are likely to arrive, so they no longer feel like sudden ambushes. The difference between waking up in a panic every morning and waking up with a clear but realistic view of your situation often comes down to this visibility.

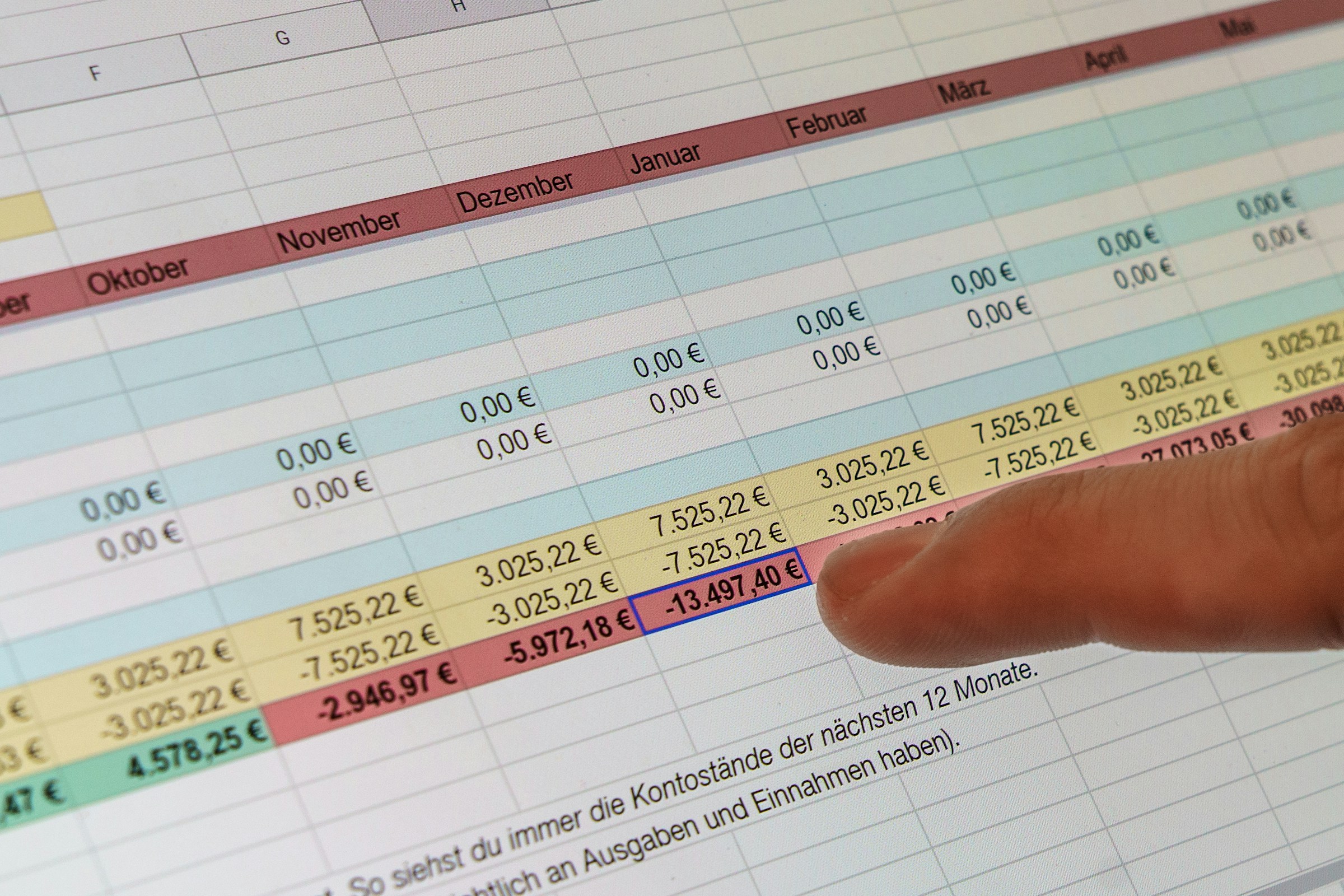

Many founders enjoy talking about profit and margins, but banks, staff, and suppliers care about something more basic, which is cash. Profit on paper cannot pay salaries or rent. Only actual cash in the account on specific dates can do that. This is where financial planning becomes very practical. Even a simple cash flow projection covering the next three to six months can place you ahead of many other small businesses. You list expected inflows, expected outflows, and their timing. Then you look for gaps. You might notice a quiet month after a busy seasonal period, or a cluster of payments where rent renewal, annual software licenses, and bonuses all fall in the same period. Those are the moments that can damage you even if your yearly profit looks positive.

If you see these cash cliffs early, you gain options. You can run promotions earlier to bring in cash, ask suppliers for staggered payments, delay a non essential project, or slow down hiring. If you see them only when the bank balance is already low, your choices shrink to panic, rushed discounts, expensive short term loans, or broken promises. None of these build a resilient business.

Financial planning also protects your people. In the early stages of a venture, employees often join because they trust the founder more than the brand. They accept uncertainty because they believe in the mission and the team. That trust is easily damaged when money issues show up as surprises. Sudden pay cuts, salary delays, cancelled bonuses, and unpaid overtime do more than hurt morale. They tell your team that the business is being run without a clear understanding of its limits.

You cannot guarantee smooth sailing, but you can know your boundaries. A financial plan shows what level of payroll you can sustain not just this month, but several months ahead under normal conditions. It highlights the true cost of adding headcount, including training, equipment, and the emotional responsibility of another person depending on you. This understanding leads to more honest hiring decisions. Instead of hiring aggressively whenever revenue spikes, you pause and ask whether you can still pay everyone if a major client leaves or a project is delayed. Hiring might become slower, but it becomes more sustainable, and you avoid the painful situation of bringing someone on only to struggle to pay them later.

Another important part of planning is separating your personal finances from the company’s money. Many small business owners treat the business bank account as if it were their own. They swipe the same card for groceries and inventory and tell themselves they will sort it out later. Over time, it becomes difficult to know whether the business is actually making money or just surviving because the owner keeps secretly supporting it.

Proper financial planning forces a cleaner structure. You pay yourself a fixed amount, even if it is modest. You stop using the business account for personal expenses and manage your household budget separately. The company becomes a distinct entity that you manage rather than a flexible wallet that you dip into. This separation helps you see whether the business model works on its own. It also makes your numbers more credible to banks, investors, and potential buyers, who will not trust financial statements that mix rent, payroll, and personal shopping in the same narrative.

Planning also changes how you deal with partners such as landlords, vendors, lenders, or investors. These parties will ask about your numbers. They want to understand your margins, seasonality, customer mix, and debt levels. If your answers are vague, you lose bargaining power. You become the person who is simply grateful for any terms offered.

However, if you have a clear plan, you know your average transaction size, your monthly burn rate, your gross margin, and the key weaknesses in your cash flow. You know which invoices you could discount or restructure and which ones are non negotiable. You understand how much debt the business can reasonably service without sacrificing flexibility. This knowledge lets you negotiate from a position of clarity. You can walk away from deals that are too restrictive or too expensive because you understand exactly how they would affect your future. Over time, saying no to the wrong offers can matter as much as saying yes to the right ones.

Financial planning also helps with the emotional side of running a business. Money stress has a way of colouring every decision. It turns minor customer complaints into crises and makes every delay feel like the beginning of the end. When you never know how close you are to running out of cash, your mind fills in the worst possible version of events, often late at night when it is hardest to be rational.

A financial plan does not remove fear, but it gives your fear boundaries. You know the worst case and the likely case. You know how many tough months you can survive and which changes would extend that runway. You know which levers exist before you are in real danger, such as reducing certain expenses, pushing for faster collections, or restructuring deals. This does not make entrepreneurship easy, but it lowers the background noise so that you can focus on product, customers, and team instead of constantly firefighting bills.

The good news is that financial planning for a small business does not require complex software or a full time finance hire at the beginning. The first version is usually a simple spreadsheet and a recurring appointment with yourself or with a co founder. The real value lies in the habit, not the tool. Once a week or once a month, you sit down, update the numbers, and ask what they are telling you. You track what comes in, what goes out, and what is left. You make realistic estimates for the next few months based on actual patterns rather than optimistic goals. You list the major obligations that are coming even if it is uncomfortable to see them in writing. The aim is not to predict every detail perfectly. The aim is to gain enough visibility to make sound choices.

As the business grows, you can adopt better tools and involve professionals such as accountants or part time finance advisors. By that time, your planning habit will already be strong, which makes any system far more effective. Without that habit, even the most sophisticated software will remain underused and outdated within weeks.

In the end, financial planning for your small business is an act of respect for your future self and for the people who have chosen to build this venture with you. You are not planning because you believe everything will go according to your spreadsheet. You are planning so that when things go wrong, they do not destroy the business you are working so hard to grow. You are planning so that salaries are not a constant question mark, so that you can say yes or no to opportunities from a place of clarity, and so that your company becomes stronger over time instead of more fragile.

If you are a small business owner, treat this as a firm but encouraging reminder. Take the time to review your numbers. Separate your accounts. Draw up a simple cash flow for the next few months, even if it feels messy. Financial planning is not a reward that comes after success. It is one of the reasons a small business survives long enough to become truly successful.

Thinking