You do not need a perfect budget. You need a budget that acts like a bouncer, a calendar, and a hype squad, in that order. First it protects what must happen so your life does not fall apart. Then it schedules the money to hit at the right time. Finally it makes it easier to say yes to the stuff you care about and harder to blow cash on what you do not. Most budgets collapse because everything is treated as equal. Rent and a random midnight cart get the same level of access. The fix is not more willpower. The fix is a ranking system that your bank or money app can actually run without you checking it every hour.

Start by accepting a simple truth. Your budget is not a math problem. It is a queue. Money lands, then it lines up for a limited number of seats. If you do not decide who gets in first, marketing will decide for you. Every subscription renewal and flash sale is a VIP guest with a fake badge. Your job is to set the real guest list and move people through the door in the right order. When you think about it that way, prioritization stops feeling like deprivation. It feels like control.

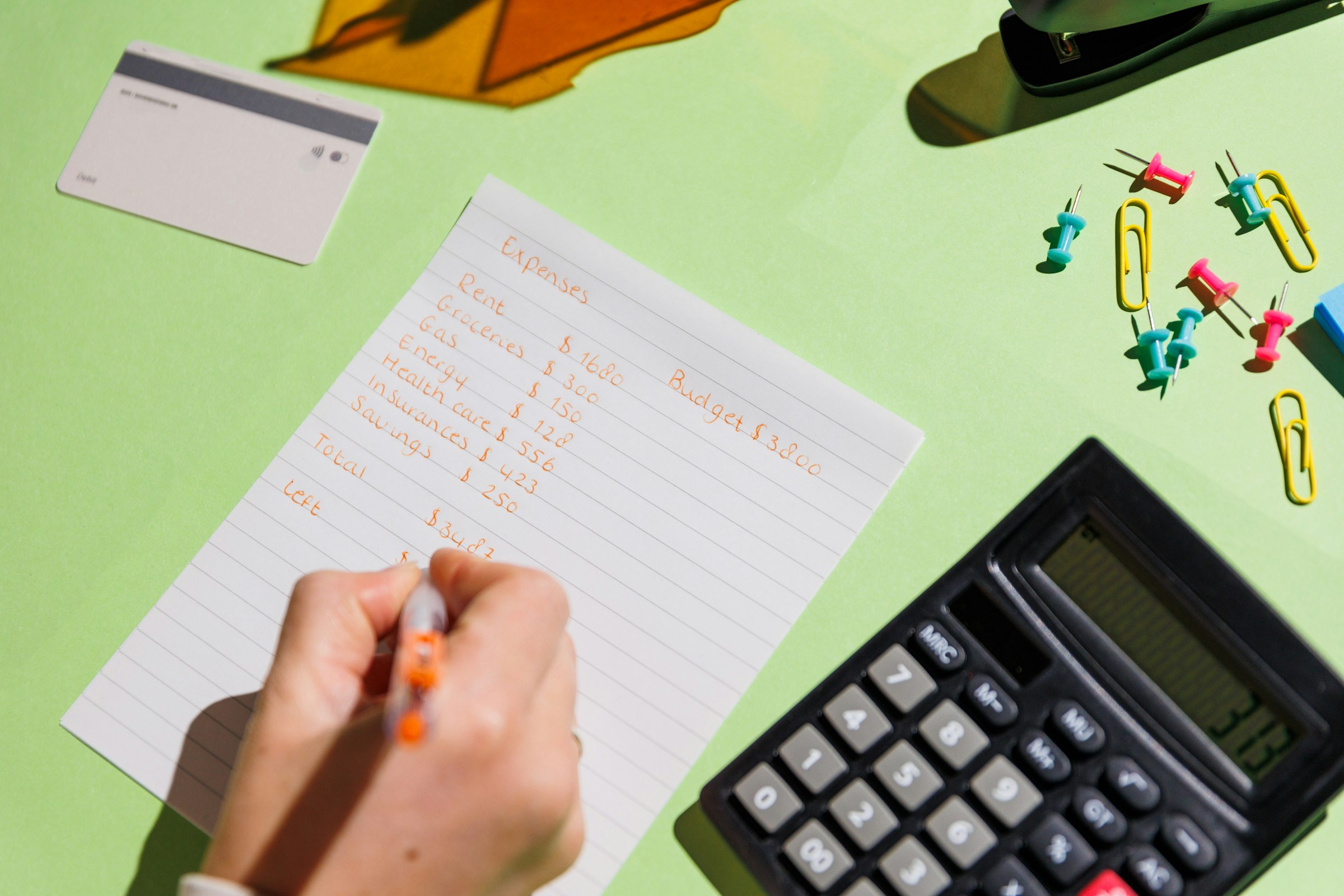

The first job is to lock down life support. That means housing, core utilities, transit to work or school, baseline groceries, and the minimum payments on any debts. These are not exciting categories, but they are the ones that protect your stability and credit score. The easiest way to enforce this is to split your paycheck at the source. Most payroll systems let you send a fixed amount to one account and the rest to another. Route the exact figure needed for these non negotiables into a bills account that you barely touch. Set the due dates in the app, line them up with payday where possible, and let automatic payments carry the weight. If you cannot split at the source, you can still create a transfer rule in your bank the minute your salary hits. The less you manually move around, the fewer chances you have to talk yourself out of a smart move.

Once life support is set, build a small cash buffer that sits between you and surprise. You are not trying to grow an epic emergency fund in a week. You are building a modest shock absorber that covers the weird little spikes that blow up otherwise decent plans. Think of things like a doctor visit, a cracked phone screen, or a fare you forgot would post later. This is separate from long term emergency savings. It is a speed bump that saves you from tapping a high interest card. Many digital banks let you create a pocket, vault, or space that is titled for a purpose. Name it something obvious so you feel protective over it. If the buffer gets used, refill it before you do anything fun. You are not punishing yourself. You are repairing the guardrail that kept you on the road.

Now you can aim at your future self. This is the part that gets skipped when everything is reactive. If you save only when there is money left over, there will never be money left over. Automate transfers into savings and investing right after the bills and buffer. If you are in school or early career, start small and consistent. If you are mid career with a stable income, ramp the amount at the same time each year and index it to any raise so you do not feel the jump. If your app offers round ups or paycheck rules, use them, but do not confuse them with a full plan. Round ups are like spare change. Useful, but not the main event.

Debt strategy sits next to savings for a reason. Interest is a fee for time, and the higher the rate, the harsher the fee. If your credit card APR is crushing, put extra toward the highest rate balance first or pick the smallest balance and kill it to free up mental bandwidth. People argue about avalanche versus snowball. The right answer is the one you will actually execute. The important part is to make it automatic. Schedule the extra payment for the same day as your credit card due date so you are not tempted to redirect it. When a balance dies, keep the payment amount alive and roll it to the next target. That is how you create momentum without micromanaging.

Lumpy expenses are the silent budget killers. You do not see them for a while, and then they arrive in clusters. Annual subscriptions renew in the same month. Gifts pile up around the same season. The car needs servicing right after you paid for a course. This is where sinking funds do real work. A sinking fund is not a vibe. It is a calendar attached to dollars. Break down the annual cost into a monthly amount and move that into a labeled pocket before it gets a chance to mix with general spending. When the renewal or expense hits, you are paying a bill you already funded in tiny, painless pieces. It feels boring until you realize your cash flow stayed calm during a month that used to be chaos.

At this point, many people ask where fun fits in. Fun sits in the design on purpose. It just does not get to jump the line. Decide what version of fun is non negotiable to you. It might be coffee out, live shows, weekend markets, or a small travel plan every quarter. Make room for that one or two things and cut the rest without guilt. You are not saying no to life. You are saying yes to what you actually enjoy. If you put everything in the top tier, nothing is special and the money ends up diluted. If you pick, your enjoyment rises because each spend means something.

Timing matters as much as categories. A beautiful plan can break if the cash arrives weekly and the bills ask for money monthly. If you get paid once a month, pay your irregulars first, then weekly release your general spending so you do not blow the first weekend and white knuckle the rest of the month. If you get paid weekly or are in gig work, flip it. Build a monthly bills bucket that accumulates as money lands, then pay the big items from that bucket on a schedule. Use calendar reminders and app notifications that nudge, not nag. A nudge that says your spending release for the week is ready feels helpful. A nag that shames you for buying lunch does not change behavior. Stick with the one that builds forward motion.

If your income is irregular, your priority stack gets even more important. Pick a low baseline figure that you can usually meet even in a slow month and build your plan around that. When a heavy month lands, do not inflate everything out of proportion. Top up the buffer, forward fund your sinking categories, and move a chunk into an income smoothing pocket. That way, next month does not feel like starting from zero. The mental health benefit of predictable money is hard to overstate. Uncertainty drains your attention and makes every decision feel heavier. Smoothing the floor gives you back a sense of control.

Housing often eats the largest slice, and it can feel fixed. Sometimes it is. Sometimes it is not. If the numbers keep breaking even after cuts elsewhere, you do not need a new budgeting trick. You need a housing reset. That could be a roommate, a renegotiated lease, or a different neighborhood. It could also be an honest look at the car that is quietly eating you alive. Insurance, fuel, and maintenance add up. A decision like selling a car or downsizing an apartment is not a small tweak, but one right sized move can do more for your budget than a year of skipping little joys that keep you sane. Do not fix structural problems with lifestyle guilt.

Subscriptions deserve a special audit because they hide in plain sight. Scroll your list and tag each one with keep, reduce, or cancel. Keep the ones you use and love often. Reduce if there is a cheaper tier or an annual plan that is clearly lower over the year and you know you will use it. Cancel what you would not fight to keep. If you are unsure, cancel and wait two weeks. If you feel nothing, you have your answer. If you miss it and it adds real value, bring it back. You do not need a master spreadsheet to do this. A monthly five minute pass is enough. Pair it with your rent or mortgage due date so the ritual has a hook.

Food spending is where plans meet real life. Cook at home every night is a fantasy for many people with long commutes, kids, or unpredictable schedules. The better move is to decide the number of meals you genuinely want to eat out and make peace with it. Then pick two convenience items that save you from meltdown nights. Frozen dumplings and a bagged salad can rescue a budget and a mood. You can be frugal without being hostile to your future self. If you constantly set rules you cannot meet, you will get numb to your own plan and ignore it when it matters.

If you manage money with a partner or roommate, the system needs transparency and autonomy at the same time. Agree on the top tier priorities together so you are not fighting every line later. Route shared obligations into a joint bills account that funds rent, utilities, and groceries. Keep separate accounts for personal spending so you do not police each other. Add a small no questions asked line for each person that can be used without commentary. This prevents a thousand micro conflicts and keeps the main plan from becoming a relationship audit.

Saving for bigger goals works best when you convert them into time and habit, not just a number. A trip in nine months is nine deposits. A laptop upgrade next summer is twelve deposits. If you treat a goal like a countdown with a recurring transfer, your brain links the act of saving with the approach of the goal. The money becomes an event you can see arriving instead of a vague hope you will fund later. If the transfer feels too heavy, reduce the amount rather than pausing entirely. Momentum beats intensity that keeps breaking.

There is a reason people who feel in control of their money talk about values. Values do not mean fancy slogans. They mean there is a clear answer to what matters more when two decent choices collide. Take a few minutes to write the three categories that give your life outsized return. Maybe it is language classes, safe and reliable tech, and weekends out in nature. When a new spend offers a hit of novelty, ask whether it pushes one of those categories forward. If it does, it competes for a higher seat in the queue. If it does not, it drops to the back. You never have to be perfect. You just need a default.

Technology helps when it makes the default easy. Rename your accounts and pockets so they act like instructions. A label that says June Rent tells you what not to touch. A label that says Saturday Takeout lets you enjoy the treat without guilt because it was baked into the plan. Use the features that your bank already offers. You do not need a dozen apps with overlapping features and surprise fees. One or two that handle scheduled transfers, category pockets, and real time notifications will carry most people. Watch for sneaky costs like instant transfer fees or premium plan upsells that do not add real utility.

Once your system is live, the maintenance load should be light. A weekly ten minute check to look for any pending charges and a monthly thirty minute review to adjust the transfers is enough. Every quarter, look at whether your priorities changed. New baby, new city, new job, or a health shift can make the old plan feel wrong. That is not failure. That is life evolving. Fold the change into the plan and keep the automation rolling.

It is easy to think the missing piece is motivation. In reality, the missing piece is sequencing. Money that goes to the right place at the right time protects your week, then your month, and eventually your year. There is no award for suffering through a plan that treats your joy like a bug. The goal is to aim your cash toward a life that feels like yours. When you get the order right, the discipline required drops because you are not making a hundred exhausting decisions. You set the line once and let the system do its work.

If you came here looking for a trick, here it is. Decide your priority stack once and express it in automation. Lock down essentials through a bills account. Keep a small buffer that you defend. Pay your future self on schedule. Attack expensive debt with an extra payment that never gets the chance to wander. Build sinking funds for the weird spikes that used to stress you out. Fund one or two joys with intention and cut the rest without drama. Sync the timing to your paycheck rhythm. Everything else is an app skin.

The phrase 'how to prioritize what’s important in your budget' sounds like a lecture until you turn it into a flow that your bank can actually run. Then it becomes a quiet system that flexes with your life. That is the point. Money is supposed to support the life you want, not stage a fight every Friday night. Start small, set the order, and let consistency do what it always does. The smartest budget is not loud. It is the one you barely notice because it lets the right things happen on time.

.jpg&w=3840&q=75)