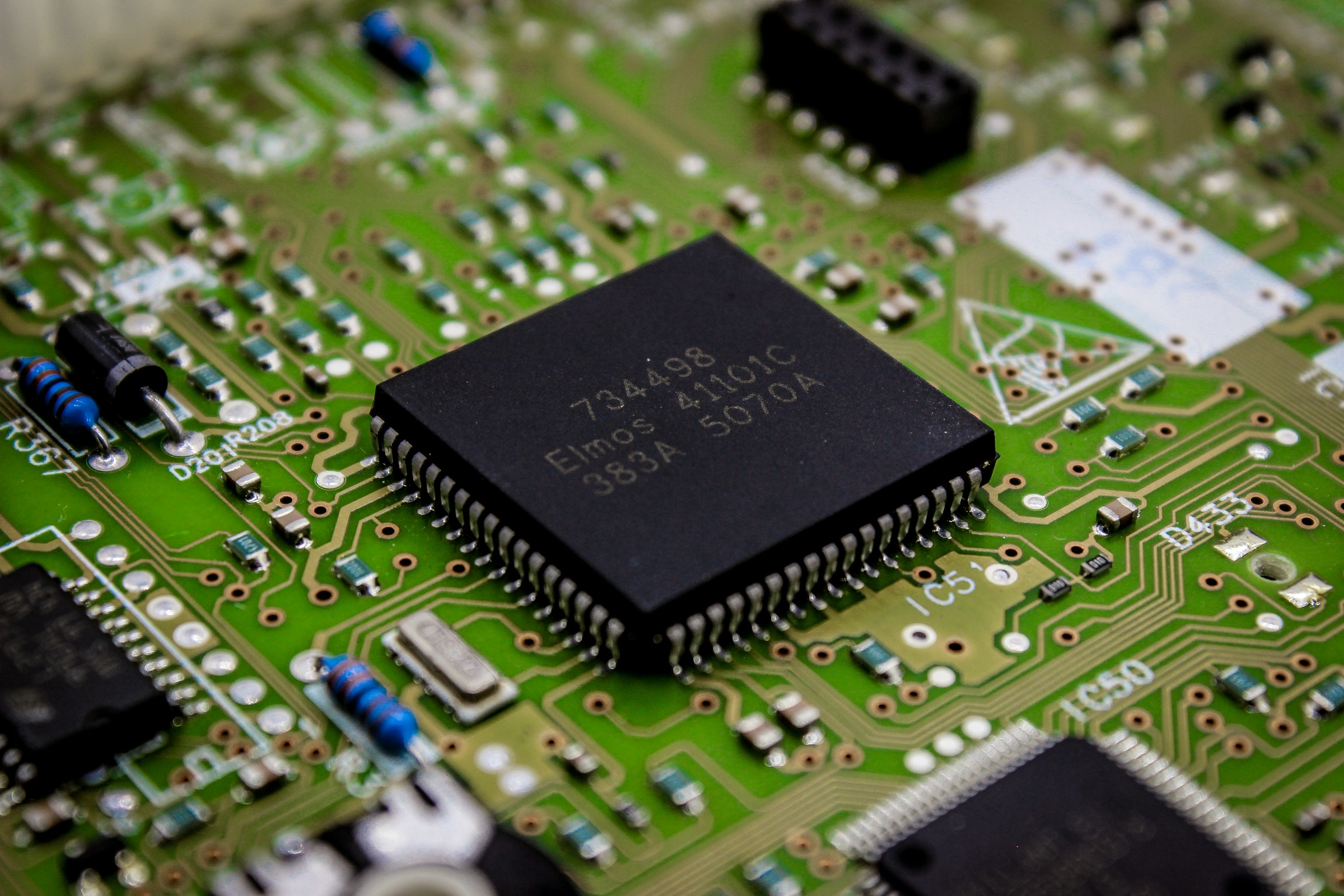

Taiwan is not resisting change—it’s choosing where to lead. The latest US trade threat—a proposed 100% tariff on imported semiconductors—sounds blunt and binary. But for Taiwan’s chipmakers, particularly TSMC, the world’s dominant contract chip manufacturer, this is less a crisis than a recalibration. The market seems to agree. TSMC shares jumped 5% after Trump’s announcement, closing at a record high.

This isn’t investor naivety. It’s a strategic pricing-in of what comes next: Taiwan’s semiconductor ecosystem, long the world’s most integrated and efficient, isn’t being dismantled. It’s being restructured. With more than US$165 billion already committed to six fabs in Arizona, TSMC is anchoring itself inside the US firewall—not as a concession to pressure, but as a way to maintain its primacy on new terms.

This tariff isn’t just economic—it’s geographic. Taiwan’s officials have been measured in tone. They aren’t declaring victory, but they aren’t projecting panic either. What’s notable is that Trump’s tariff scheme allows exemptions for companies with US-based production. That puts TSMC in a uniquely insulated position. Smaller Taiwanese chipmakers, however, aren’t so lucky. Without a US footprint, they face rising demand-side pressure from multinational clients who now need tariff-proof supply.

This is how industrial policy works in 2025: not by banning trade, but by redrawing incentives. What looks like protectionism at the headline level is functionally a realignment strategy—pushing capacity closer to end markets and reducing geopolitical exposure.

This shift is not deglobalization—it’s targeted redistribution. Taiwan still produces 60% of the world’s chips, and nearly all of the most advanced ones. That won’t change overnight. What will change is the locus of marginal investment. When clients ask suppliers to produce from Arizona instead of Hsinchu, they’re not questioning quality—they’re hedging against future tariffs, policy changes, and political risk. It’s a supply chain reshuffle, triggered not by cost optimization but by political logic.

In the short term, this bodes well for TSMC. In the long term, it forces Taiwan’s semiconductor sector to balance two roles: the high-tech nucleus of global innovation, and a scalable partner to geographically dispersed ecosystems.

Europe and the Gulf are also recalibrating. The US isn’t alone in its industrial self-interest. The EU’s Chips Act and state-backed deals in France and Germany aim to woo top-tier foundry capacity. In the Gulf, sovereign funds are pivoting toward AI infrastructure, semiconductor packaging, and niche design capabilities. These markets don’t seek to replace Taiwan—but they want pieces of the stack onshore.

This raises a structural question: can Taiwan remain the operating system of the chip world, even as components of its stack are pulled elsewhere? If TSMC keeps control of the most advanced nodes—3nm, 2nm, and beyond—the answer is yes. But if client-led decoupling drags mid-tier capacity away, Taiwan risks becoming the elite R&D lab with shrinking volume leverage.

What looks like US favoritism is really global risk management. The ambiguity in Trump’s tariff proposal is itself a strategic device. It forces companies to make proactive moves, even without full clarity. Will the tariff apply to chips embedded in devices? Will it count components fabricated overseas but tested in the US? Nobody knows yet—and that’s the point. Multinational firms are already adjusting strategy not based on rules, but on anticipated interpretations.

Qualcomm, Arm, Apple—they all rely on TSMC’s Taiwan fabs. Unless those designs are manufactured locally, the tariff’s reach could extend through rules-of-origin reinterpretations. That’s why the Arizona investment isn’t just a PR move—it’s insurance. It anchors TSMC’s clients and shores up its bargaining power.

The winners are those who move before the rules harden. Taiwan’s strategic edge has always been operational clarity, scale, and technical depth. But in this new tariff environment, agility matters just as much. The question for Taiwan’s smaller fabs isn’t whether they’ll survive—but whether they’ll remain integrated in the global tier-one value chain. If they can’t secure US production, they risk being boxed into lower-margin, politically exposed positions.

Conversely, new entrants—whether US startups, European second-tier fabs, or Middle Eastern design houses—may gain share by default, simply by being “inside the fence.” But that’s not always a win. Without Taiwan’s technical ecosystem, scaling advanced chip production will be slow, expensive, and error-prone.

TSMC’s moves set the tone—but Taiwan must shape the narrative. There’s a geopolitical undertone to all of this. Trump’s tariff isn’t just about supply chains—it’s about signaling US tech dominance. For Taiwan, the challenge is to remain indispensable without becoming captive. That requires more than Arizona fabs. It requires ownership of the narrative: Taiwan as the orchestrator of global chip capacity—not just the warehouse.

To do this, Taiwan must double down on two fronts. First, preserving its high-end leadership through constant node advancement. Second, ensuring that outbound capacity—from the US to the EU to the Gulf—remains under strategic coordination, not just contractual obligation.

This is not about tariffs. It’s about strategy. What began as a political headline has become a case study in asymmetric industrial adaptation. Taiwan isn’t fighting back with threats or retaliatory policy. It’s adapting faster, hedging smarter, and repositioning its value. The country’s chip ecosystem may shrink at home—but its influence is expanding abroad. That’s not surrender. That’s strategy.

And as always, the players moving before the dust settles—not after—will define the next cycle.

.jpg&w=3840&q=75)