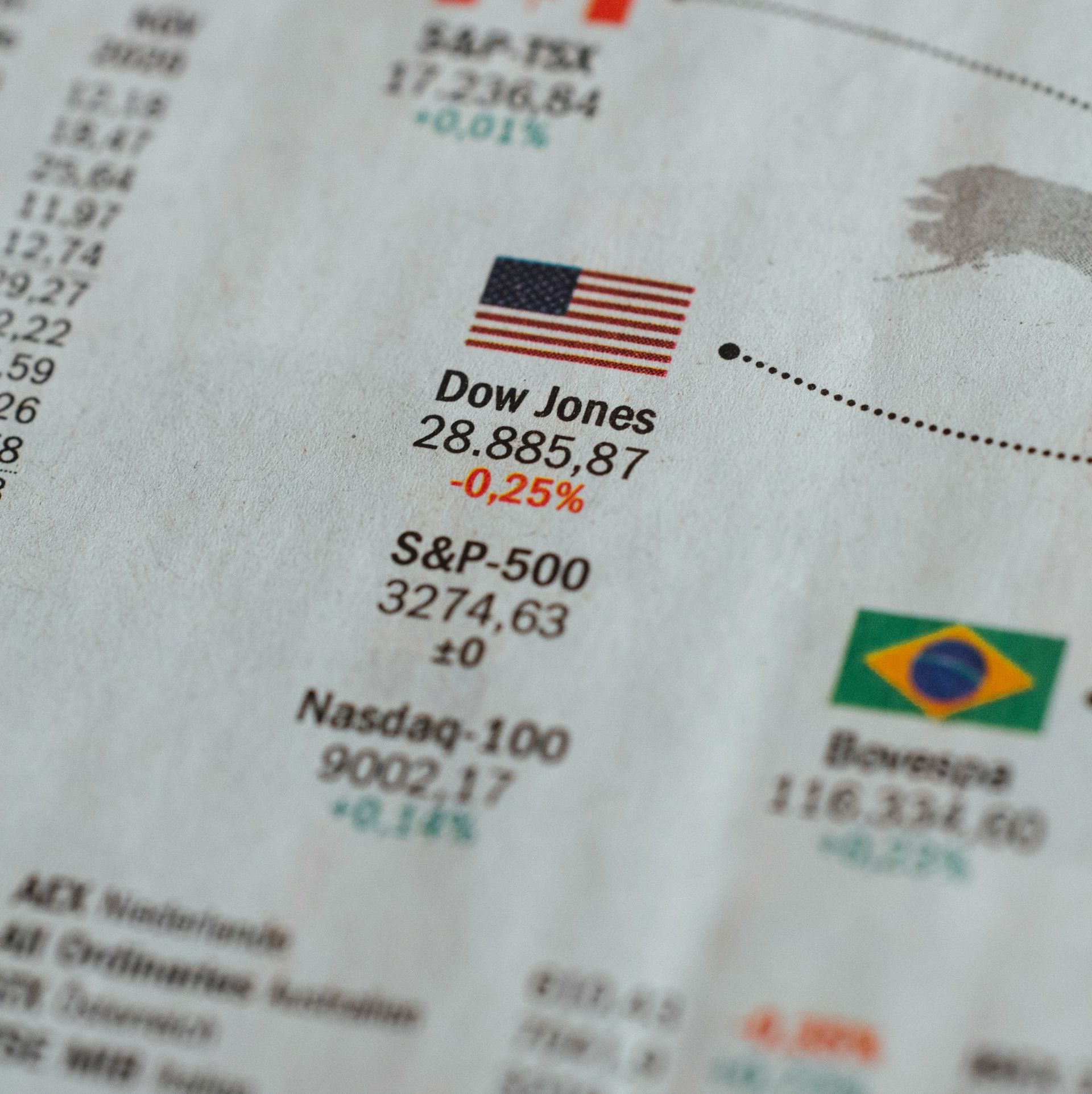

The headline move looked simple: mega-cap tech down, defensives up. Underneath, the logic was more interesting. On August 20 in New York, the Nasdaq fell 0.68% and the S&P 500 slipped 0.26%, while the Dow finished essentially flat. Energy, healthcare, and staples caught a bid as the S&P tech cohort lagged, a pattern that reads like valuation discipline returning after months of AI-charged gains.

Call it what it is: rotation, not capitulation. The setup had been building. A summer rebound led by the same handful of platform names stretched multiples while real cash yields stayed high enough to challenge long-duration growth narratives. Add a heavy macro week—Jackson Hole on deck and fresh Fed minutes that reinforced a “hold for now” stance—and the market finally priced a little execution risk back into the AI story. In other words, “Nasdaq, S&P 500 end lower as investors sell tech” captured a flow shift that product teams would recognize immediately: when the promise curve runs ahead of the usage curve, the budget owner blinks first.

What changed today wasn’t the existence of AI demand; it was confidence in near-term monetization speed. Analysts flagged two reality checks amplifying the turn: public comments warning of froth in AI leaders and fresh research pointing to how hard it is to convert generative pilots into profit at scale. That kind of narrative doesn’t kill a platform, but it does pull forward the CFO’s question about payback windows, which is exactly how rotations like this start.

Policy signal risk crept in at the edges, and markets noticed. Headlines about possible government equity stakes in strategic chipmakers—coming just weeks after unusual revenue-sharing terms with GPU leaders—add a new dimension to the chip-cycle playbook. Subsidy-era industrial policy can be supportive on the way up and constraining when priorities shift; either way, it inserts a second stakeholder into capex and margin math. Traders marked the semis lower on the day and circled a near-term catalyst: Nvidia’s August 27 print, now a referendum on whether AI demand is deep enough to ignore the policy noise.

Jackson Hole adds a clean macro overlay. With July minutes showing most FOMC members content to hold the policy rate, the path to any September cut still runs through inflation stickiness and growth resilience. If Chair Powell leans cautious, duration-sensitive tech will keep trading like a call option on cheaper capital; if he opens the door wider to cuts, the beta comes back fast. Either way, the message from the curve to high-multiple software and silicon is unchanged: cash yields still matter, and they compress the narrative premium when earnings visibility blurs.

Strip away the noise and you can see the product-model tension clearly. The AI stack is demand-rich and revenue-frictioned. Training costs remain front-loaded. Inference margins depend on smarter routing and disciplined workload design. Enterprise buyers are enthusiastic in pilots but strict in procurement, and pay-as-you-grow contracts push revenue recognition into the right tail. That’s a fine setup for a multi-year diffusion curve, but it’s a fragile one for quarter-to-quarter momentum trading—especially when defensives offer steadier cash flows at lower multiples. On days like this, portfolio managers rebalance their own “LTV/CAC” across sectors: what cash do I spend (multiple) for what stream of value (earnings durability), and how quickly does it pay back (rate path)?

The internals reinforced that story. Chips and hyperscale-exposed names led declines, with other mega-caps slipping in sympathy, while old-economy cash machines absorbed the flows. Investors didn’t sell risk; they sold expensive duration and bought visible cash. The tape’s resilience late in the session—S&P down just a quarter-point by the close—supports the rotation thesis over the liquidation one.

For operators and product leads, this is the same lesson dressed in market clothes. If your growth case relies on headline adoption rather than contracted, usage-linked revenue with improving unit costs, expect the market to haircut your multiple when macro uncertainty rises. The fix isn’t narrative; it’s throughput. Shorten time-to-value for enterprise buyers. Tame inference cost per user story. Derisk model-serving with workload-aware pricing that aligns incentives across your vendor stack. The more your P&L looks like a utility—predictable, usage-efficient, policy-agnostic—the less your stock trades like a macro proxy.

Miles’s take: the ecosystem is fine; the model got ahead of itself. Rotations like today’s are the market’s way of forcing product discipline back into valuation. Powell’s tone at Jackson Hole and Nvidia’s print will move the next chapter, but the underlying truth won’t change. It’s not that AI can’t monetize. It’s that the Street will keep charging you a premium for promises until you make the usage curve pay your bills.

.jpg&w=3840&q=75)

.jpg&w=3840&q=75)